Century Communities Stock: An Attractive Way To Play Housing (NYSE:CCS)

Table of Contents

Toggle [ad_1]

jimfeng/E+ via Getty Images

Although a significant amount of focus in the housing market has been shifting in the direction of multi-family properties, the fact of the matter is that there are still many single-family properties being developed and sold. One of the players in this space that deserves attention is Century Communities (NYSE:CCS). With a market capitalization of just $1.76 billion, this enterprise is fairly small. However, financial performance in recent years has been remarkable. Moving forward, the picture is rather unclear. This is because, while the company has done well and while there is a national housing shortage, the rise of interest rates and the possibility of a struggling economy moving forward might impair the business’ potential in the near term. Having said that, shares are priced low enough today that even if such a negative circumstance were to come to pass, Century Communities will likely fare well in relation to some other players in this market.

A Rapidly-Growing, Single-Family Play

According to the management team at Century Communities, the company operates as a homebuilder that focuses on entry-level, first and second-time move-up, and lifestyle home buyers, the homes that they are searching for. Operationally speaking, the company is organized into five different segments. Four of these are based on specific regions. They are West, Mountain, Texas, and Southeast. West consists of the company’s homebuilding operations in California and Washington state. Mountain focuses on Arizona, Colorado, Nevada, and Utah. Texas is self-explanatory. And Southeast focuses on Florida, Georgia, North Carolina, South Carolina, and Tennessee. The company also has a fifth segment called Century Complete, which focuses on identifying entry-level home buyers and makes sales to those customers through the company’s retail studios, as well as online. In addition to the states the company’s other segments operate in, Century Complete also serves customers in Indiana, Kentucky, Alabama, Ohio, and Michigan.

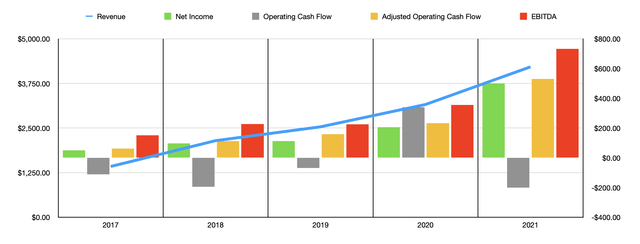

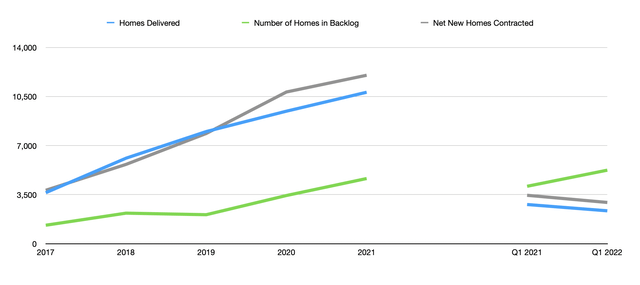

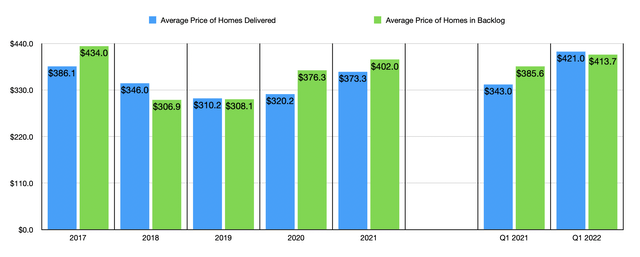

Author – SEC EDGAR Data

Over the years, Century Communities has really experienced significant growth. The company has seen its revenue increase in each of at least the past five years, with sales climbing from $1.42 billion in 2017 to $4.22 billion in 2021. This growth has been driven by a few different key factors. The most important has been the number of home deliveries the business has achieved. Back in 2017, the business delivered just 3,640 homes nationwide. By 2021, this number had grown to 10,805. Interestingly, the average price per home sold has not risen consistently. This number actually decreased from $386,100 in 2017 to $310,200 in 2019. The figure then did increase modestly in 2020 before jumping to $373,300 in 2021. Despite the surge in home deliveries, the backlog on the company’s books also expanded. This grew from 1,320 properties in 2017 to 4,651 last year. Interestingly, the average price per unit in its backlog has followed a slightly different path. After dropping from $434,000 in 2017 to $306,900 in 2018, it began a consistent incline, eventually hitting $402,000 at the end of last year.

Author – SEC EDGAR Data

Thanks to the strong top line performance, Century Communities experienced a nice bit of upside on its bottom line as well. The company went from generating a net profit of $49.9 million in 2017 to $206.2 million in 2020. In 2021, profits grew further, climbing to $498.5 million. Operating cash flow has been far more volatile, with no clear trend visible. But if we adjust for changes in working capital, the metric would have increased from $61.1 million in 2017 to $531.1 million in 2021. Meanwhile, EBITDA for the company also increased, climbing from $150.5 million to $732.7 million over the past five years.

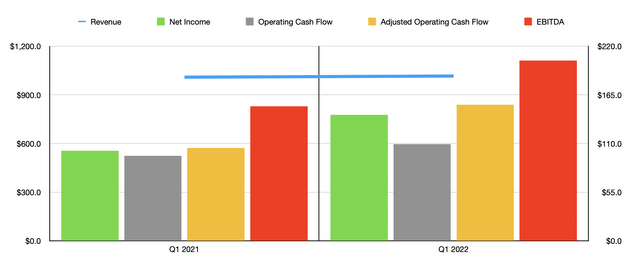

Author – SEC EDGAR Data

When it comes to the 2022 fiscal year, the business is off to a pretty good start. Revenue of $1.02 billion in the first quarter of the year was slightly higher than the $1.01 billion the company generated one year earlier. This came even as the number of homes delivered dropped year over year, falling from 2,797 in the first quarter last year to 2,348 the same time this year. The company made up for this, instead, in the form of higher pricing. Average prices in the latest quarter totaled $421,000. That compares to the $343,000 reported for the first quarter of 2021. For anybody who has been following the broader economy closely, this shouldn’t be shocking. Not only does an increase in interest rates cause the construction of properties to cost more. There’s also the fact that inflation is impacting the picture, as is the fact that there are, today in the US, as many as 5.5 million fewer homes than what we need. To illustrate how problematic this situation is, consider that in February of this year alone, the most recent month for which data is available, home prices came in 19.8% higher than they were one year earlier.

Author – SEC EDGAR Data

Despite this pain, the company’s bottom line has also improved. Net income in the latest quarter was $142.5 million. That compares favorably to the $101.7 million seen one year earlier. Operating cash flow increased, rising from $96.1 million to $109.4 million. The increase was even more drastic when you adjust for changes in working capital, with the metric rising from $105 million to $154 million. Meanwhile, EBITDA for the company increased, rising from $152.1 million last year to $203.7 million this year. It’s also worth noting that the number of units in backlog the company has also rose, climbing from 4,097 in the first quarter of last year to 5,247 this year, even as the average price per unit grew from $385,600 to $413,700. Having said that, some cracks are showing. For instance, the number of net new home contracts the company landed in the latest quarter came in at just 2,944. This is down from the 3,455 the company reported one year earlier. That said, it is also important to realize that the company does have a significant amount of potential inventory available. At present, the number of controlled lots in the company’s inventory is 85,577. That compares to the 57,536 in inventory one year earlier and it is up from the 79,859 lots the company reported for the end of its 2021 fiscal year. This means that the firm can readily build more if demand calls for it.

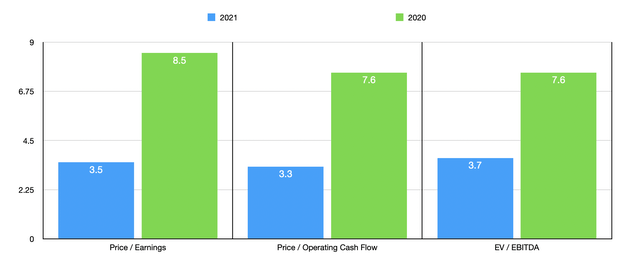

Valuing a company like this can be a bit tricky. This is because we don’t know if or when the bottom will fall out. If the economy worsens materially, or if housing prices continue to rise, we could very well experience a multi-year slowdown or contraction in the housing market even in spite of the inventory shortage. Because of this, I think it is risky to analyze the company based on its most recent financial results. But for the sake of comprehensiveness, I would do that but also look at the company through the lens of the results it achieved in 2020. Using the 2021 results, the business is trading at a price to earnings multiple of 3.5. The price to adjusted operating cash flow multiple is even lower at 3.3, while the EV to EBITDA multiple comes in at 3.7. Instead of this, we can also use the 2020 results. These multiples would come in at 8.5, 7.6, and 7.6, respectively.

Author – SEC EDGAR Data

To put the pricing of the company into perspective, I decided to compare it to five similar firms. Using the price to earnings approach, these companies ranged from a low of 3.3 to a high of 12.8. Using our 2021 results, I found that Century Communities is cheaper than all but one of the firms. If we use our 2020 results, only two of the businesses are cheaper than our prospect. Using the price to operating cash flow approach, the range was from 6.8 to 117.6. Our 2021 results would mean that ours is the cheapest of the group, while the 2020 results would make it so that only one of the five companies can be purchased at a lower multiple. And finally, we have the EV to EBITDA approach. In this scenario, the range is from 3.6 to 10.7. Our 2021 results would make it so that only one of the five companies can be purchased for less than Century Communities. But if we switch to the 2020 results, we find that four of the five are cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Century Communities | 3.5 | 3.3 | 3.7 |

| Dream Finders Homes (DFH) | 11.4 | 26.4 | 10.7 |

| Tri Pointe Homes (TPH) | 4.8 | 8.3 | 4.6 |

| Cavco Industries (CVCO) | 12.8 | 14.6 | 10.3 |

| M/I Homes (MHO) | 3.3 | 6.8 | 3.6 |

| LGI Homes (LGIH) | 6.0 | 117.6 | 6.4 |

Takeaway

Based on all the data provided, Century Communities seems to represent an interesting opportunity for value-oriented investors. Shares of the company look cheap in most respects, both on an absolute basis and relative to peers. The firm continues to grow at a nice clip, though current market conditions might change that in the near-term. As the EV to EBITDA valuation approach indicates, leverage for the enterprise is a bit high if performance worsens back to 2020 levels. But absent that, the company seems to be in solid shape.

[ad_2]

Source link

You may also like

Archives

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- October 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- December 2021

- October 2021

- September 2021

- August 2021

- November 2018

- October 2018

- January 2017

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||