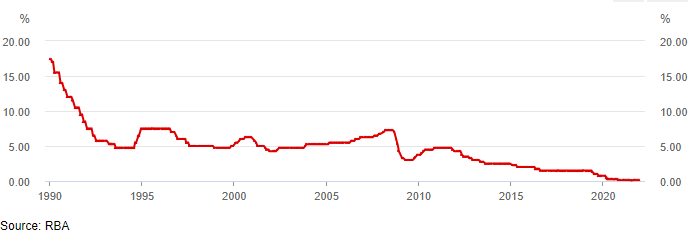

Cash Rate On Hold at 0.10%

Table of Contents

Toggle [ad_1]

Statement by Philip Lowe, Governor: Financial Plan Selection

At its conference these days, the Board resolved to maintain the funds fee goal at 10 basis points and the curiosity price on Exchange Settlement balances at zero per cent.

Graph of the Cash Charge Target

Bond Yields

Inflation has amplified sharply in several parts of the environment. Ongoing offer-facet problems, Russia’s invasion of Ukraine and solid need as economies recover from the pandemic are all contributing to the upward tension on price ranges. In reaction, bond yields have risen and expectations of long run policy desire charges have increased.

Omicron Outbreak

The Australian economic system remains resilient and paying out is choosing up subsequent the Omicron setback. Household and small business harmony sheets are in typically very good condition, an upswing in company expenditure is underway and there is a significant pipeline of design function to be accomplished. Macroeconomic coverage configurations also remain supportive of advancement and national revenue is being boosted by larger commodity prices. At the identical time, increasing prices are placing strain on household budgets and the floods are leading to hardship for numerous communities.

Labour Market

The toughness of the Australian economic climate is obvious in the labour market, with the unemployment charge slipping further more to 4 for each cent in February. Underemployment is also at its cheapest stage in many yrs.

Job vacancies and task adverts are at higher degrees and place to continuing powerful progress in employment over the months in advance. The RBA’s central forecast is for the unemployment fee to fall to down below 4 for every cent this year and to continue being under 4 per cent future 12 months.

Wages expansion has picked up, but, at the mixture amount, is only all over the comparatively low prices prevailing just before the pandemic. There are, nevertheless, some regions exactly where more substantial wage raises are taking place. Provided the tightness of the labour sector, a further decide on-up in combination wages expansion and broader steps of labour fees is in prospect.

This decide on-up is nonetheless envisioned to be only gradual, whilst there is uncertainty about the conduct of labour prices at traditionally reduced stages of unemployment.

Inflation

Inflation has improved in Australia, but it continues to be decrease than in several other nations in fundamental terms, inflation is 2.6 for each cent and in headline conditions it is 3.5 for every cent. Bigger prices for petrol and other commodities will final result in a even more lift in inflation about coming quarters, with an up-to-date set of forecasts to be released in Might.

The most important resources of uncertainty relate to the velocity of resolution of the several source-aspect problems, developments in world-wide power marketplaces and the evolution of all round labour expenses.

Housing Markets

Fiscal conditions in Australia continue on to be very accommodative. Desire premiums keep on being at a really low degree, despite the fact that mounted mortgage costs for new financial loans have risen not too long ago.

The Australian dollar trade rate has appreciated because of to the higher commodity charges and, in TWI conditions, is close to the amount of a calendar year back. Housing rates have risen strongly over the past year, whilst some housing marketplaces have eased just lately.

With fascination costs at traditionally very low stages, it is important that lending expectations are managed and that borrowers have adequate buffers.

The Decision

The Board’s insurance policies through the pandemic have supported development to the aims of complete employment and inflation reliable with the focus on.

The Board has required to see precise evidence that inflation is sustainably within the 2 to 3 for each cent target array ahead of it boosts desire rates. Inflation has picked up and a more boost is predicted, but growth in labour costs has been below charges that are likely to be consistent with inflation being sustainably at focus on.

Around coming months, essential added proof will be accessible to the Board on each inflation and the evolution of labour fees.

The Board will evaluate this and other incoming data as its sets plan to assistance entire employment in Australia and inflation outcomes reliable with the focus on.

[ad_2]

Resource website link