The massive problem for prolonged-time owners right now is having to pay out funds-gains tax on the web income that is Higher than the exempted $500,000 for married couples. While the 2-out-of-5-yr rule that was passed in 1997 is because of for some altering, there haven’t been any indications that the politicians will re-stop by the situation.

What can homeowners do to lessen the tax owed?

- Document Your Costs. All home improvements (not repairs) and closing costs are extra to your home’s price foundation (order price tag), which assistance to reduce the taxable gain.

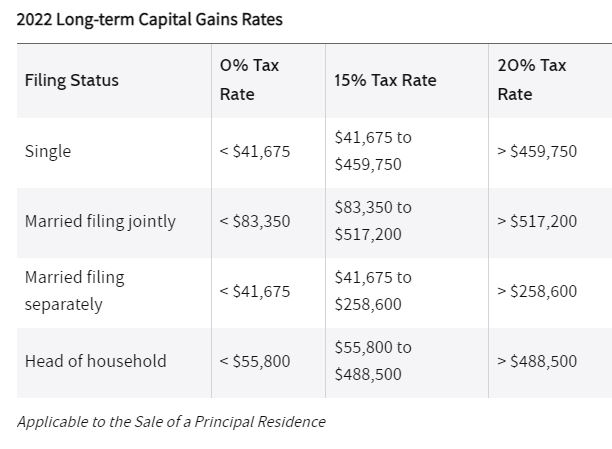

- Have the Financing. Have a significant equity placement and don’t need to have all the money? Consider payments from the purchaser more than time, alternatively of acquiring all the funds at closing. Require a massive down payment so you would obtain a great chunk up front, and then collect on a 5% mortgage in excess of the following 5-10 decades. You only shell out tax on the money obtained, so structure it so you fall down into the 15% tax bracket for the initial year:

- Lease it out for a calendar year and do a 1031 Trade. Just after renting your home out for a yr, you could trade it for a different rental property and postpone the capital-gains tax indefinitely. You have to rent out the new residence also for at least a 12 months right before occupying as your home, so it is a 2+ calendar year undertaking – but hey, no tax! If you don’t need to live there, an additional option is to get a home in an ‘opportunity zone’. Investors begin to get pleasure from a move up in foundation just after 5 several years. Just after 10 several years, the gains become tax-cost-free!

- Offset with money losses from somewhere else. Enterprise and inventory losses can be involved in the identical tax return to offset the cash gains.

- Transfer just about every time your internet obtain rises up to $500,000. You might have to choose a hit this time, but to keep away from having to pay out cash-gains tax all over again in the long run, transfer more normally. 🙂

- Dying correctly. The stress of staying the remaining spouse just after a whole lifestyle together can be devastating, but at least he/she will have the charge foundation enhanced to the home’s value on the working day of demise – with no capital-gains tax owed. Make positive to have your relatives have faith in named as owner of the residence.

- Wait around until eventually your home’s price goes down. This isn’t likely to take place, so concentrate on 1-6 over!

Virtually each and every lengthy-time property owner has found their fairness rise enough in the very last 12 months to include their tax publicity, and didn’t that truly feel like free of charge income? In its place of fretting more than obtaining to fork out the federal government, just get pleasure from the ample quantity remaining above – you created more than they did! Or employ the strategies over.

Test with your tax preparer for additional specifics.