Warren Buffett Buys REITs Instead Of Real Estate, Here’s Why

Table of Contents

Toggle

Warren Buffett is a single of the quite couple buyers to have managed to compound returns at a 20% annual regular for extra than 50 a long time.

Any one can triumph above a 5-10 yr time interval, but the true test is regardless of whether you can preserve heading for 10 years following ten years, and Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) is one of the scarce exceptions to have achieved that:

| Berkshire Hathaway | S&P 500 (SPY) | |

| Compounded Once-a-year – 1964-2020 | 20.% | 10.2% |

| Over-all Acquire – 1965-2020 | 2,810,526% | 23,454% |

So, when he talks, we pay attention.

In today’s article, we seem closer at his method to serious estate investing. More than the years, he has typically discussed why he hardly ever buys real estate, but far more not long ago, he has produced huge investments in the REIT sector (VNQ).

Below we emphasize 5 factors why Warren Buffett favors REITs around private house investments:

Motive #1: No Aggressive Gain

In a shareholder meeting many years back, Warren Buffett describes that they are not equipped to compete with investors who focus in authentic estate investing.

The fascinating matter here is that again then Warren Buffett by now had invested tens of millions into serious estate, experienced major sources via Berkshire, and Charlie had made his preliminary fortune in genuine estate.

Even then, they felt that they could not compete with REITs and other LPs that specialised in serious estate investing and had an informational edge around them.

Right here you must question oneself: If Warren and Charlie are unable to contend in the authentic estate area, can you?

A whole lot of individual investors assume that right after seeing a several YouTube movies and obtaining a serious estate investing training course from an online guru, they’re very well well prepared to turn out to be authentic estate investors.

In fact, most traders are overconfident and overestimate their capabilities. Warren Buffett is quite sensible about his restrictions and understands that except if you are 100% concentrated on true estate, you are not likely to obtain very good outcomes investing in it.

Rationale #2: Absence of Mispricing

To some degree linked to cause #1, if you are not thoroughly dedicated to real estate, you are unlikely to come across mispriced possibilities.

Warren Buffett points out that mispricings in genuine estate are exceptional. The industry is somewhat productive at pricing hazard due to the fact most investors are very long-term oriented.

On the other hand, mispricings are far more frequent in the stock current market since most investors are shorter-phrase-oriented and swift to panic when they see their inventory decrease in benefit.

Warren believes that if you are an active trader, you happen to be more very likely to obtain far better discounts in the stock market place, which includes REITs, than in non-public actual estate.

That’s what he stated years in the past and it is perfectly reflected in present day sector.

Suitable now, housing is red scorching, and industrial genuine estate is selling at historically minimal cap fees. The price ranges replicate the extremely-small fascination level environment that we live in.

Even then, the REIT current market is today seriously mispriced. Many REITs, including blue-chip names like W.P. Carey (WPC), Realty Money (O), and National Retail (NNN) are down by 20-30% even as their fundamental attributes are additional precious than ever before.

That is a superior possibility.

Reason #3: Company Tax Drawback

Berkshire Hathaway is structured as a company and it is liable to corporate taxes.

Charlie and Warren reveal that this puts them at a big disadvantage relative to REITs, which are exempt from company taxes.

If you generate a 6% yield on a house, the REIT is still left with 6%, but Berkshire is still left with a reduce gain because of to taxes.

Even then, Berkshire has created REIT investments, which are far more tax effective because REITs only pay back out 50%-70% of their cash flow in dividends, and the rest is retained at the REIT degree and not taxed. Also, REITs have a larger development/appreciation part than non-public real estate, which outcomes in decrease corporate taxes.

Reason #4: Management And Scalability

In an job interview throughout the excellent money crisis, Warren Buffett explains that if he experienced a way to competently manage serious estate, he would load up on one-relatives houses.

A large amount of traders make the mistake of assuming that real estate is a passive investment when in truth it can be administration intensive.

You are working with the dreaded 3 Ts: Tenants, bathrooms, and trash.

Could Warren Buffett hire a property administration enterprise? Absolutely sure, he could. In truth, he would get a substantially superior offer than you or me if he did that.

Nonetheless, the issue with house administration firms is that their costs consume into your profitability, but even more importantly, their passions are not aligned with yours. Buying a home and handing the keys to a assets manager is the equal of obtaining an externally-managed REIT, which we all know, is not often a great idea owing to conflicts of interest.

With regular REITs, Warren Buffett receives skilled management that is very well aligned with shareholders and enjoys considerable economies of scale.

You also can effortlessly deploy cash in a handful of clicks of a mouse, which can make it uncomplicated to scale your investments over time.

Explanation #5: Alternatives are in REITs Nowadays

Warren Buffett is a price investor.

He would like to invest in superior-high quality belongings at a discounted to reasonable benefit.

But as mentioned previously, the personal serious estate market place is currently crimson sizzling. With the exception of a handful of challenged sectors (business office, malls, and so forth.), you might be not likely to obtain discounted possibilities. The desire for non-public actual estate is bigger than at any time prior to owing to the ultra-small desire charges.

Even then, numerous REITs are today priced at historically small valuations, and not remarkably, that’s what Warren is shopping for. Below we highlight one particular of his beloved REITs:

Retail outlet Capital

Berkshire Hathaway very first acquired shares of Keep Capital (STOR) back in 2017, and a short while ago, they doubled down.

As a outcome, they now possess just about 10% of the fairness:

According to an job interview of Chris Volk, CEO of Store Funds, it is Warren Buffett that was powering this expense. You can skip to the 8:55 mark to understand much more about Warren Buffett’s investment in Store:

What’s so distinctive about Retail outlet Cash?

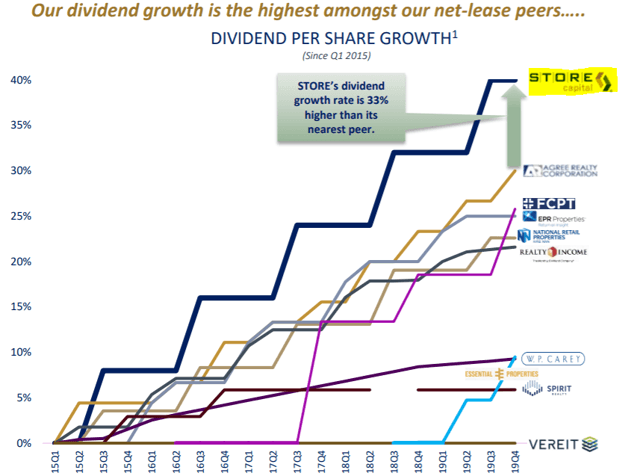

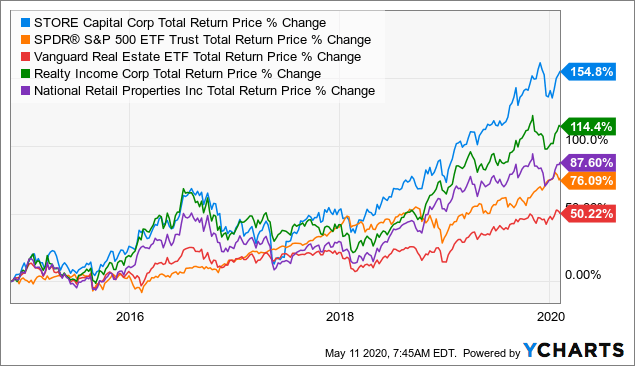

In brief, STOR has a unique strategy that generates larger returns with decrease chance than what Berkshire could realize on its have. We examine this strategy in detail in a separate report so we will not likely go into the information in this article, but its approach has regularly led to substantial outperformance relative to its shut peers, and this is possible to continue on much into the long term:

Even then, STOR has been priced at an extremely reduced valuation in excess of the past yr. It’s continue to ~15% decrease than prior to the pandemic, and that is regardless of hiking its dividend by 3% in 2020 and guiding for file-high dollars move in 2022.

You only are unable to locate this form of option in the personal authentic estate sector and which is why Warren Buffett favors REIT investments.

Currently, there are ~25 similar REIT prospects in which we are investing at Large Produce Landlord.