Canadian commercial property purchases strike record $14-billion in 2nd quarter

Table of Contents

ToggleIndustrial land has turn into the prime pick for commercial real estate buyers as people ever more count more on e-commerce for every little thing from groceries to clothes.

Jeff McIntosh/The Globe and Mail

Investment decision in Canadian commercial assets hit a document $14-billion in the second quarter, as purchases of warehouses, land and condominium structures soared.

Industrial house, land and multi-household housing was now coveted prior to the pandemic altered shopper behaviour, including forcing more men and women to store on the net. That, in convert, has ramped up demand from customers for warehouses, as properly as land to develop industrial homes this kind of as distribution centres.

“COVID assisted the industrial sector,” reported Paul Morassutti, vice-chair of business serious estate business CBRE.

Tale carries on below advertisement

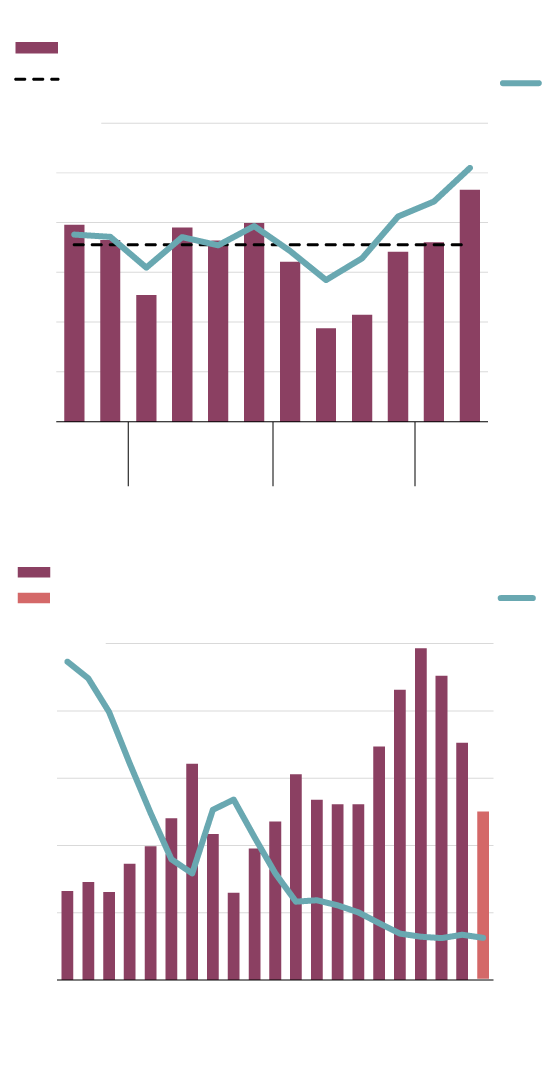

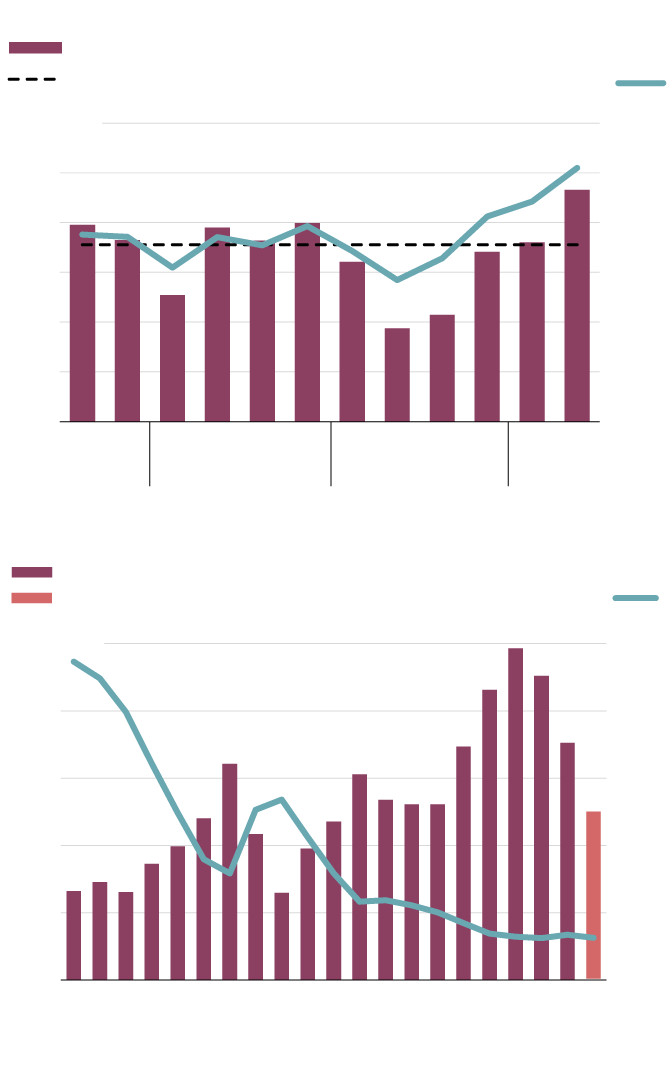

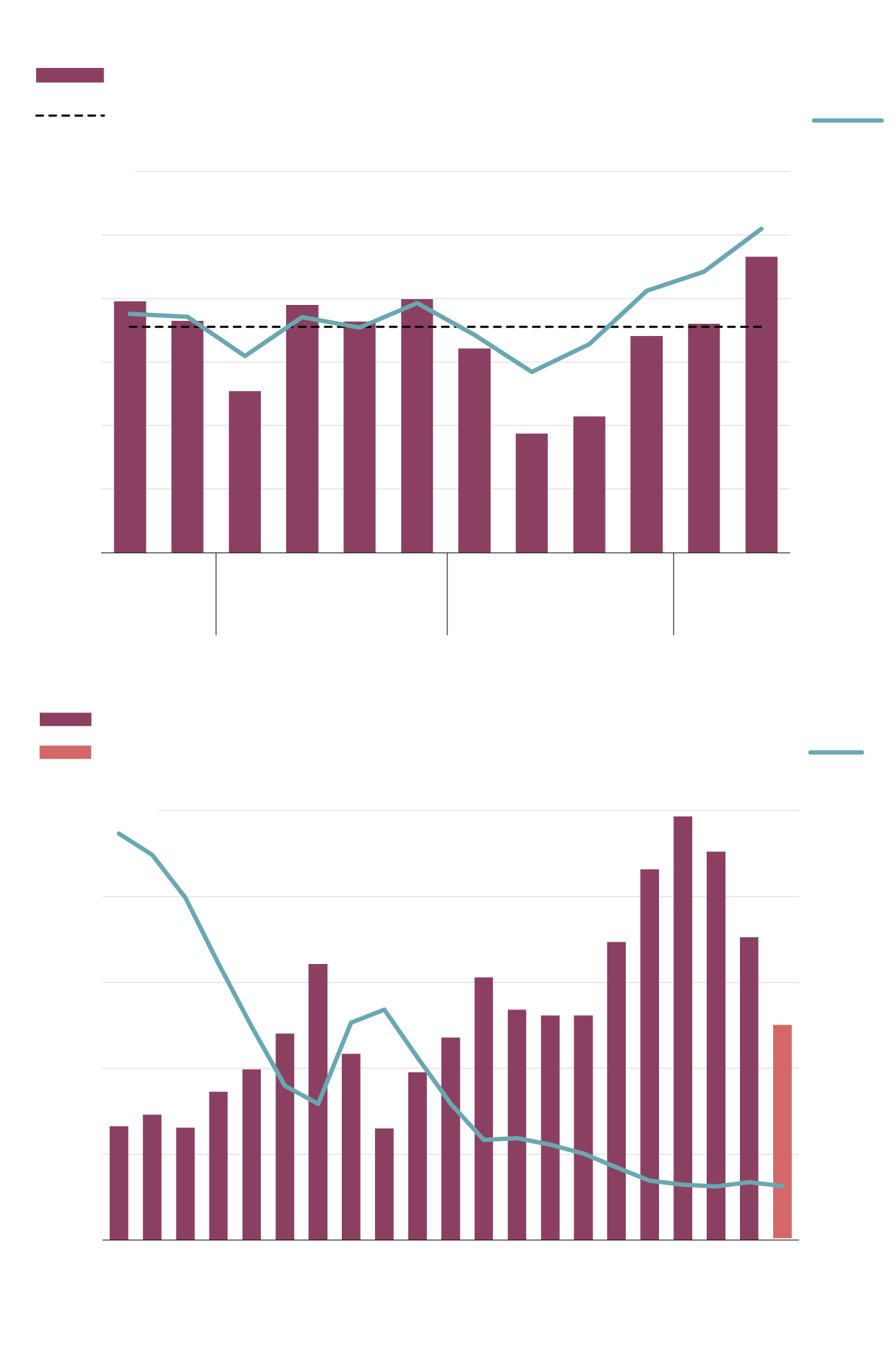

Nationwide financial investment activity by quarter

Historic nationwide investment decision activity by 12 months

THE World AND MAIL, Source: cbre

Countrywide financial investment action by quarter

Historic national financial investment action by 12 months

THE World AND MAIL, Source: cbre

National expense activity by quarter

Historical national investment decision exercise by yr

THE World AND MAIL, Source: cbre

The next quarter’s financial investment figure is 29 for each cent higher than the initially quarter, and far more than double the same period previous calendar year, when fears of an financial collapse halted most deal action, in accordance to new information from CBRE.

Merged with $10.8-billion in commercial home acquisitions in the to start with 3 months of the calendar year, expenditure quantity is on keep track of to surpass the file $49-billion attained in 2018, when a large office deal aided force the quantity higher.

This 12 months, rich Canadians, high-web-well worth residents, as effectively as scaled-down enhancement businesses and personal-equity corporations, account for just about 50 percent of the purchases. Real estate expense trusts, more substantial non-public-fairness companies, pension cash and overseas traders ended up dependable for the remainder.

The top rated transaction was a $194.5-million purchase of 59 acres of industrial land in northern Toronto, followed by two other industrial land purchases in the Toronto region, in accordance to CBRE.

Industrial land has turn out to be the prime select for professional serious estate traders as consumers more and more depend much more on e-commerce for everything from groceries to clothes. The pandemic accelerated the shift toward e-commerce, as limits on malls and other in-man or woman retailers forced Canadians to store on the internet. Amazon and some others are searching for far more warehouse house in close proximity to and en route to main urban centres to assistance deliver items quickly to homes.

“The e-commerce influence on warehousing and logistics experienced been actively playing out for a lot of a long time. COVID accelerated it occasions 10,” Mr. Morassutti said.

Other significant offers past quarter included Killam Apartment REIT’s $190.5-million acquisition of apartment structures in Ontario’s Waterloo region, house to two universities and a tech hub. As properly, buys of industrial genuine estate, land and condominium properties have been major transactions in Vancouver, Edmonton, Calgary, London, Ont., Montreal and Halifax.

Story carries on under ad

A person business offer bucked the pattern. Personal-fairness company KingSett Funds ordered a $193-million purchasing centre in Ottawa, even although malls had fallen out of favour with buyers ahead of pandemic limitations demanded operators to briefly near them to stem the spread of the virus.

World serious estate owners these as Ivanhoé Cambridge and Brookfield Asset Management have either divested or introduced strategies to shrink their portfolio of malls.

Workplace buildings have also dropped their glow with the pandemic’s do the job-from-household mandates and gradual return to places of work. Even nevertheless tenants are having to pay their rent and some companies this sort of as Shopify Inc. and Amazon.com Inc. are increasing their workplace footprint in Canada, there is uncertainty over the upcoming of business office perform. Huge end users of business area, this sort of as banks and insurers, have stated they will shift to a extra flexible perform ecosystem. It is unclear irrespective of whether that indicates all those office tenants will ultimately need to have significantly less house.

Mr. Morassutti claimed he thinks investors will sooner or later arrive again to the office sector but mentioned all those purchasers “would like to see bodily occupancy in people properties increase.”

Your time is precious. Have the Top rated Business Headlines newsletter conveniently delivered to your inbox in the early morning or night. Signal up currently.