Making Sense of the Multifamily Market Today – June 2022

Table of Contents

Toggle [ad_1]

The multifamily sector these days is the strangest in my rather limited job (12 decades). The selection of potential financial outcomes is huge, and I absolutely absence the practical experience to assess the influence inflation, costs, and a economic downturn may well have on the multifamily market about the near-time period.

What is good about owning this outlet is that I get to compose items down and feel out loud, documenting my feelings and carrying out my greatest to make sense of the current market.

Although admittedly I’m not confident what is likely to transpire, the over-used adage rings accurate – when record may possibly not repeat alone, it does rhyme.

Let’s crack matters down into a few unique segments inflation/prices, single-loved ones housing, source/desire fundamentals, and queries/things to view.

Inflation / Fees

Actual estate, and multifamily in distinct, is a very good inflation hedge. Rents reset each day, and leases generally roll each and every 12 months. Hire expansion at our present attributes have much outpaced inflation.

Even though inflation fears are superior these days, the consensus is that it will be tamed, but at what price tag?

Provided inflation is a reasonably brief-phrase concern, the market place is reacting a lot more acutely to the rise in curiosity rates. The surge in borrowing charges have pushed up cap rates and brought the money marketplaces to a momentary freeze. This has been most noteworthy on price-include deals where buyer’s usually put on high leverage.

I assume prices to stay high, but normalize and appear back again down as recession fears set in. Spreads really should also stabilize as we get far more clarity on the market place path.

Solitary-Relatives Housing

The one-loved ones housing industry is terribly unhealthy today. Logan Mohtashami from HousingWire has the some of the clearest housing evaluation which goes like this (primarily based mostly on this posting):

- The operate up in housing price ranges more than the past 2 several years has been pushed largely by inventory remaining at all-periods lows at a time when housing demographics have been exceptionally robust.

- Stock has been steadily falling considering the fact that 2014 and is in an harmful situation currently. Customarily inventory amounts are amongst 2 million and 2.5 million. We started off 2022 at just 870,000 households for sale.

- A occupation-reduction recession would be necessary to build any form of distress. However, the purchaser is in a strong economical place these days.

- Increased charges will slow housing demand and we’re now viewing acquire apps slowing, but it is going to acquire a although for stock levels to raise drastically.

Unaffordable housing is a boon for multifamily desire in the small-phrase, but in excess of the extended-expression higher fees will slow housing demand from customers and moderate pricing, therefore creating one-relatives housing extra economical.

The Renter

American shoppers reman in good financial wellness because of to the mix of a robust labor sector, wage development, minimal leverage, and operate up in housing charges and the stock market.

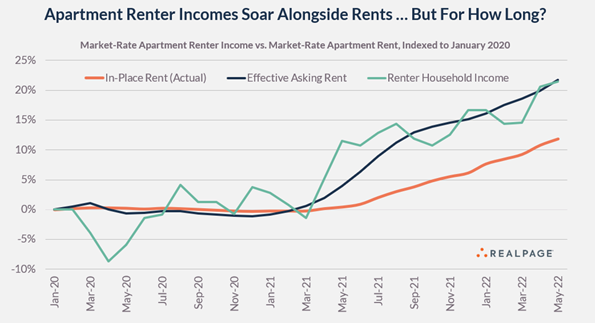

A single of the greatest drivers and a single of the most important question marks today is what happens to renter household incomes goin forward. When I wrote about the SE multifamily sector again in January, I questioned ‘are rents outpacing wages in these markets to these kinds of an prolong that there are not more than enough higher-having to pay work opportunities to assistance them?’

That continues to be the most important question about the multifamily marketplace today. Incomes and rents are carefully corelated. As expenses go on to surge, most notably payroll, insurance policy, utilities, R&M, and taxes, there continues to be strain to force rents.

If wage growth stagnates, we’ll see additional doubling up, lessen retention, and a reduction in new lease desire. See the chart below from Jay Parsons of RealPage demonstrating the tight correlation among incomes and rents.

Multifamily Supply/Need

Demand from customers

The multifamily fundamentals continue being potent. Career expansion and wage development are both envisioned to remain wholesome. Moreover, the uncoupling of younger grown ups from mothers and fathers and roommates will continue on to benefit in the vicinity of expression demand from customers. On the other hand, the demographics soften as the 25–34-12 months-aged cohort grows at <0.5% per year over the next 3 years, then declines starting in 2025 (Green Street).

Additionally, the recent rise in rates and the likely impending recession may lead to hiring freezes and layoffs in certain sectors, resulting in slower than expected job growth.

Revenue growth will continue to be strong due to mark-to-market of the rent roll (especially in the Sunbelt) but will likely slow due to deteriorating macroeconomic conditions.

Supply

On the supply side, development delays have helped insulate apartment fundamentals. However, supply will grow over the coming years as the units under construction eventually deliver and the starts/permits continue to accelerate.

Tightening credit markets and rising construction costs may restrain supply in the short-term, but rising rents (and attractive profit margins) will keep a floor under starts.

Supply will vary by market with the Sunbelt markets seeing accelerating supply growth over the next 2-3 years. There are no absorption issues today, and broad-based excesses in supply are unlikely in the near-term given the strong demand, but select markets are heading for over-supply.

Questions/Things to Watch

- Are we heading for a recession and if so, how severe will it be?

- Will the labor market remain tight and will wage growth continue?

- Will supply catch up to demand and are select markets over-supplied?

- Are rents outpacing wage growth, leading to expanding rent-to-income ratios?

- Will rates normalize then begin to decline as recession fears set it?

- When will supply-chain issues taper and will construction costs come back down any time soon?

While this is my attempt of making sense of today’s market, I remain focused on buying and building multifamily assets to hold long-term in markets with strong fundamentals.

The world belongs to people who play long-term games and know how to take a punch.

When in doubt, zoom out.

— Sahil Bloom (@SahilBloom) June 13, 2022

[ad_2]

Source link